More Years, More Money

The good news is, odds are, you'll probably live longer than past generations. The bad news is, living longer means you'll need more money for retirement – possibly up to 30 years' worth. Whatever your retirement dream is – whether it's traveling the world, playing golf or just relaxing and enjoying the grandkids – the last thing you want to worry about is outliving your money.

A good rule of thumb is to save enough money to make sure you live the way you've always lived. You can't expect to spend less on living expenses in your later years than you do today. Most financial professionals agree that you'll need 70-80 percent or more of your pre-retirement income to maintain your lifestyle in retirement.

Also keep in mind that the cost of retirement living continues to increase as the cost of healthcare, housing, energy and other costs increase. And don't underestimate the power of inflation, as even low inflation can damage the purchasing power of your retirement dollars. For example, if you project a 3% inflation rate over the next 25 years, a gallon of milk purchased today for $4.29 will cost you $8.98 in 2035.

So, while your expenses may at best remain the same, or even increase, you can't expect the same for your income. That's why every day that goes by in which you don't save is another dollar you likely won't have in retirement.

Save now, pay later

One of the simplest ways to begin saving is to consider taking advantage of your employer-sponsored retirement plan, such as a 401(k), 403(b) or 457(b) Deferred Compensation plan. And if you're worried about whether you can afford it, keep in mind that such plans can help save you money today and down the road. Here's how:

Your money is your money-maker

When you invest, you earn interest on your money. And then that interest earns interest. That's called compound interest, and it's how your account can grow over time. The sooner you start, the longer your money can work for you.

Compounding circumstances

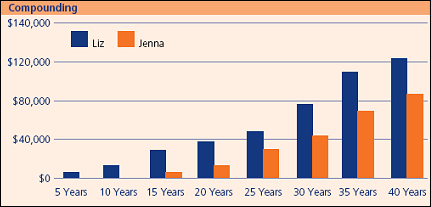

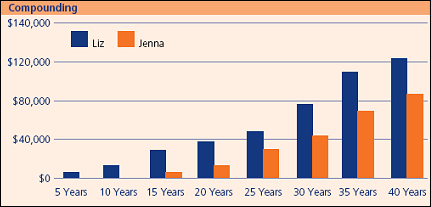

Liz and Jenna, both 25, started work for the same employer on the same day. Liz began making a monthly contribution of $100. Jenna chose to wait another 10 years before contributing to the plan. Liz stopped investing after 15 years, while Jenna continued to invest $100 a month until she retired at age 65. Both contributed $100 a month, totaling $1,200 each year. Both earned a 6 percent rate of return on their investment.

Liz invested for 15 years and a total of $18,000; Jenna invested for 30 years and a total of $36,000 – more than double Liz's investment. Yet Liz still came out ahead. (See chart.)

That's the power of compounding! Remember, this is simply an example of how compounding interest could work for you. Your actual results may vary.

This illustration does not reflect the performance of any specific investment. It assumes a 6.00% annual rate of return (compounded monthly) and that contributions are deposited at the beginning of each month. The returns are hypothetical and do not reflect the past or future performance of any specific investment option. Payment of income taxes is not reflected. Systematic investing does not ensure a profit or protect against loss. You should consider your ability to invest consistently in up- and down-markets.

Provided for your educational use only by planwithease.com.